But if the same deposit had a monthly compound interest rate of 5%, interest would add up to about $64,700. While compound interest is interest-on-interest, cumulative payroll expert support interest is the addition of all interest payments. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total initial principal or amount of the loan is then subtracted from the resulting value.

Back to Albert EinsteinWith such potential for astronomical growth, it’s no wonder Albert Einstein called the power of compound interest the most powerful force in the universe. The problem though, is that there is substantial doubt he actually said that. In 1916 a character in an advertisement in a California newspaper called “compound interest” the “greatest invention the world has ever produced”.

Compound Interest in Investing

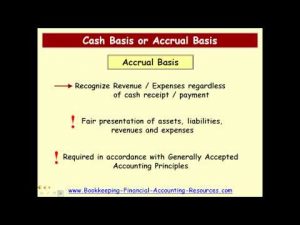

Salespeople can cleverly disguise themselves as advisers, and skepticism helps protect people from making poor financial decisions. The Truth in Lending Act (TILA) requires that lenders disclose loan terms to potential borrowers, including the total dollar amount of interest to be repaid over the life of the loan and whether interest accrues simply or is compounded. Investors can also get compounding interest with the purchase of a zero-coupon bond. Traditional bond issues provide investors with periodic interest payments based on the original terms of the bond issue. Because these payments are paid out in check form, the interest does not compound. When you hit your 45-year savings mark—and your twin would have saved for 15 years—your twin will have less, although they would have invested roughly twice your principal investment.

Never blindly pursue high-return investments

Because it grows your money much faster than simple interest, compound interest is a central factor in increasing wealth. Compound interest is interest that applies not only to the initial principal of an investment or a loan, but also to the accumulated interest from previous periods. In other words, compound interest involves earning, or owing, interest on your interest.

One reply on “Compound Interest Is Man’s Greatest Invention”

For Einstein, advanced education is not job training, but training to perform at high levels in any situation, job or otherwise. This agrees with my view on education, with its worth being measured in more than just financial return on investment. Would Einstein feel the same way now, with a college education costing several multiples more than it did in his time, even after taking inflation into account?

They may have other expenses they feel more urgent with more time to save. Yet the earlier you start saving, the more compounding interest can work in your favor, even with relatively small amounts. Saving small amounts can pay off massively down the road—far more than saving higher amounts later in life. The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate.

How Can I Tell if Interest Is Compounded?

- Albert Einstein definitely leaned towards the socialist end of the economic spectrum, but he always emphasized the important of individual freedom, democracy, and personal liberty.

- He loved the idea that he and others could question authority without fear of reprisal.

- Despite his world travels and, especially later in his life, his ability to command top salaries and fees, he maintained modest living environments.

- The longer the investment period, the more you will benefit from compound interest.

June Greg’s father deposited $6.11 into her account 98 years ago, when she was only two years old. My colleague Conrad deAenlle also wrote about this money in the bank. Sometimes a comment is attributed to a zoho books review – accounting software features famous individual to increase the prestige and believability of the comment. Also, a quotation from a famous person is often considered more interesting and entertaining. I am good at financial planning and keep track of the latest developments in financial products and services.

Financial planning is a life-long project; the earlier you start financial planning, the sooner you can enjoy the benefits and achieve your equity definition financial goals. Albert Einstein was arguably one of the most brilliant thinkers in the twentieth century. Einstein might have more to offer today’s thinking saver than just compound interest. Whether he said these words or something similar is relevant only to purists who say serious journalists shouldn’t attribute quotes willy-nilly to emphasize their importance.

He clearly sees the importance of cognitive ability and education for growing human capital, which has a positive effect on options for long-term wealth. Compounding periods are the time intervals between when interest is added to the account. Interest can be compounded annually, semi-annually, quarterly, monthly, daily, continuously, or on any other basis. The compounding frequency is the number of times per given unit of time the accumulated interest is capitalized, on a regular basis. The frequency could be yearly, half-yearly, quarterly, monthly, weekly, daily, continuously, or not at all until maturity. Most people would go for the $10 million option as it is hard to imagine that $1 doubling 30 times will become $1.07 billion!

Neither the article or the bank said how much the $6.11 would have grown to today. But if the account paid a 2 percent interest rate, June would now have $42.55 and could buy a moderately priced dinner to celebrate her 100th birthday. The above example of doubling a dollar a day may sound unrealistic. However, in the real world, many do expect to have their investment returns double within a short period of time But the fact remains, the higher the potential returns, the higher the risks. Simply put, the more returns you seek, the higher the chance of losing money.