This allows transparency, effectivity, and better pricing for the dealer. The know-how and infrastructure required to develop a direct market access buying and selling platform can be costly to construct and maintain. We mentioned probably the most related concepts of direct market entry within the buying and selling domain on this blog.

Since they ‘make the market’ for the safety, they are therefore sometimes called market markers. Today, traders can commerce securities by putting orders instantly on the order books of inventory exchanges and digital communication community brokers (ECNs) by way of direct market entry (DMA trading). DMA empowers traders to become market makers somewhat than worth takers. It’s the gateway to a variety https://www.xcritical.in/ of financial markets, including commodities, indices, foreign exchange, and shares. In this sense, the buying and selling platform is the middle man, as it has entry to exchanges and collates the most effective prices, and the software program places orders on your behalf. This is as a result of you’re putting an order over a metaphorical counter, simply as you would at a store.

Here at CAPEX, we give our merchants entry to over 36 different international stock exchanges that embody the likes of the NYSE, NASDAQ, EURONEXT, DAX and many more. Direct market access buying and selling could be overwhelming for brand spanking new merchants which is why it is suggested Direct Market Access that solely the more superior traders take up this buying and selling type. Below, you’ll discover all the data on what it takes to successfully use a DMA account and the way CAPEX can present this for you in the near future.

Other than that, be sure to check back in with us often to see what new options we’ve added to our platform and of course to see after we unveil our DMA account possibility. All orders are visible to the complete market, which allows market participants to successfully gauge market liquidity. In a typical anonymous ECN model, the person client should have secured their own credit score line from a traditional Prime Broker or Prime of Prime supplier to have the ability to take part within the ECN. This website could be accessed worldwide nonetheless the data on the website is related to Saxo Bank A/S and isn’t specific to any entity of Saxo Bank Group. All clients will directly engage with Saxo Bank A/S and all shopper agreements will be entered into with Saxo Bank A/S and thus ruled by Danish Law.

The Trader Has More Control

Over–the-counter (OTC) dealing refers to trades that aren’t carried out through centralised exchanges. In an over-the-counter market, parties quote costs for financial merchandise through a community of dealers or intermediaries. The international change market does not function through centralised exchanges and is due to this fact traded via the OTC route. Electronic communication networks (ECNs) and aggregators provide overseas trade quotes from various banks to deliver together patrons and sellers.

This means you get actual market and stock market prices and can see the depth of the market. Market maker brokers don’t use DMA as they create their own market by setting the bid and asking prices. Unlike DMA brokers, who present direct entry to the order books of their liquidity providers, meaning when you place your trades, it goes on to the order books of the liquidity supplier. A Direct Market Access (DMA) broker supplies you with direct entry to the interbank market or order books via digital amenities at financial buying and selling exchanges. Using DMA means you see all stay market costs and the instrument’s full ‘depth of market’ before you full your order which is done immediately with the liquidity provider.

Direct Market Entry Trading Platforms

This means the orders you place immediately impact the provision and demand of an asset. Changes in supply and demand affect the market which suggests your strikes are affecting the prices everybody else sees. All of this occurs within the background and might take just a few seconds.

- This can additionally be as a outcome of buying and selling in such excessive frequency could only be profitable should you trade actually high amounts of volume.

- For instance, in case your trade volume was $300 million USD up to now month, a fee of $30 will apply for every $1 million USD you trade subsequently.

- But, it’s traditional that direct market entry forex brokers cost a small mark-up on the bid-ask unfold, and there won’t be any other fee payment for the orders.

- IRESS Viewpoint Essential combines the earlier two platforms into an all-in-one CFD trader.

- Since they ‘make the market’ for the security, they’re subsequently often referred to as market markers.

You also can trade contracts for distinction (CFDs) utilizing direct market access. Whatever instrument you commerce, you’ll place an order immediately onto the order books of an exchange. We’ve found Pepperstone to be one of many premier brokers operating underneath a no-dealing desk or ECN/STP execution mannequin. We’re notably impressed by how Pepperstone operates beneath many regulatory our bodies globally, together with ASIC, CySEC, BaFin, DFSA, FCA, CMA and SCB. We have ranked, in contrast and reviewed a few of the finest direct market entry brokers in the UK that will assist you choose essentially the most acceptable account on your buying and selling technique.

However, they typically require a bigger capital investment and could additionally be more complex to make use of than normal buying and selling accounts in terms of fee structure. The prime use case of Direct Market Access is buying and promoting traditional shares, where you’ll have the ability to see what number of shares are available at specific prices. This allows you to see if people are closely promoting or buying based mostly on the variety of shares available at specific costs.

There, you presumably can see different market participants’ orders and gauge market sentiment in your chosen asset. DMA could be a good way for advanced traders to get a more comprehensive view of the market, and see the best possible costs out there. Contracts for distinction (CFDs) are trades between a CFD provider and a consumer. A CFD does not give possession of the underlying financial instrument to the consumer. It is an agreement between the CFD provider and the shopper to settle in cash the distinction between the opening and shutting prices of the CFD. The CFD supplier will base the worth of a CFD on the price of the underlying monetary instrument in the direct market.

Forex

Forex brokers with DMA have larger market depth (liquidity) and superior spreads, with the top brokers offering this feature listed under. Banks and different financial institutions provide shoppers with direct market access to electronic services and order books of exchanges to facilitate and full trade orders. With direct market access, a dealer has full transparency of an exchange’s order e-book and all of its trade orders. Direct market entry platforms can be built-in with refined algorithmic trading methods that can streamline the buying and selling process for larger efficiency and value financial savings. The common service for retail traders to get access to foreign exchange markets is given by what is called a broker’s dealing desk. The broker’s dealing desk is in charge of optimizing one of the best route for the retail traders’ orders to succeed in the institutional banks.

The Good Money Guide is a UK-based information to world buying and selling, funding and forex accounts. We provide professional reviews, comparison, news, evaluation, interviews and guides so you can choose the most effective supplier for your wants. We’ve recognized that Pepperstone’s Razor account provides some of the industry’s best spreads. Impressively, for the widely-traded EUR/USD pair, they go as low as 0.09 pips.

62% of retail investor accounts lose money when buying and selling CFDs with this supplier. You should think about whether or not you perceive how CFDs, FX or any of our other merchandise work and whether or not you can afford to take the high danger of shedding your cash. These could embody asset administration companies and personal buyers. In the international exchange market, orders are often placed on the order books of ECNs. In the share market, orders for DMA share trading are often placed within the central restrict order book of an change. Their order books comprise of the ask prices of financial products on provide by sell side members, and the bid costs for a similar by buy aspect members.

You won’t be spending money for excessive charges on each single considered one of your transactions and trades on our platform. Direct market access (DMA) is a method of putting trades immediately onto the order books of exchanges. DMA offers higher visibility of the market, whereas IG’s L2 Dealer expertise aggregates costs from a number of exchanges. However, it’s usually really helpful for advanced traders solely – as a end result of dangers and complexities concerned. A DMA buying and selling platform can be very helpful for block trades, as direct market entry software program is prepared to place massive volumes of trades in a single go, with a speedy execution and results. There is no difference between a DMA and an STP broker, as they’re the identical dealer type.

How Does Dma Work?

Pepperstone constantly delivers among the many industry’s lowest spreads for his or her primary and razor account varieties, because of their advanced pricing enchancment technologies. Knowing that multiple world regulatory bodies oversee this broker can be reassuring. In our experience, if you’re on the lookout for a top-tier dealer with no commissions, Pepperstone is the clear selection. Apart from STP, we famous FP Markets also provides DMA trading for shares on their IRESS buying and selling platform. Interestingly, while foreign exchange is available on this platform, it uses ECN pricing instead of DMA.

The thing to find out about this platform is that you’ll not be using DMA by default. Traders using this platform could have market-maker execution, which suggests spreads don’t have commissions. You will need to activate DMA mode in order to benefit from this function. Direct market access (DMA) differs from over-the-counter (OTC) in that DMA locations trades immediately with an change while OTC occurs outdoors of exchanges and instantly between parties. DMA offers extra transparency, liquidity, regulation, and better pricing. While brokerage firms can work on a market-making quote foundation, it has become more widespread for the rationale that Nineties for brokerage platforms to use direct market entry for completing the trade.

– Good Dma Share Buying And Selling With Metatrader 5

Once we have our DMA account up and operating, we are going to present our traders with entry to those stock buying and selling auctions where unbelievable buying and selling opportunities could be found. We should also note that it’s a good idea to tread with some warning with these auctions. While you possibly can completely find distinctive trading alternatives, you can also take significant losses while trading auctions as properly. So, what tools and features would a dealer need in order to have a satisfying DMA trading experience? As a DMA account is all about direct access to inventory exchanges, you’ll must have a strong range of exchanges to select from to have the ability to actually have a comprehensive DMA buying and selling experience. More so than that, you’ll need access to the proper inventory buying and selling tools as well just as you would for a CFD company account.

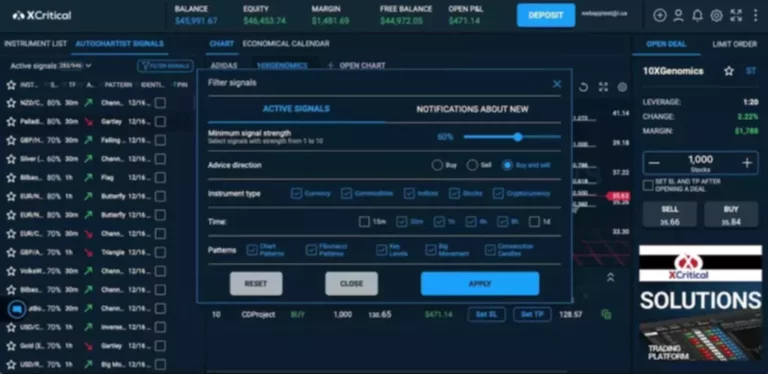

While some CFD brokers have Forex with DMA trading (IG Group for one) very few brokers supply this. One standout characteristic we’ve appreciated in our trading journey with Pepperstone is their price improvement know-how. In volatile markets, value swings can sometimes disadvantage traders. With this know-how, after you’ve positioned a commerce, Pepperstone endeavours to safe that extra favourable rate for you if there’s a helpful worth movement. For many, DMA buying and selling execution seems as an attractive proposition.